Long-term outlook.

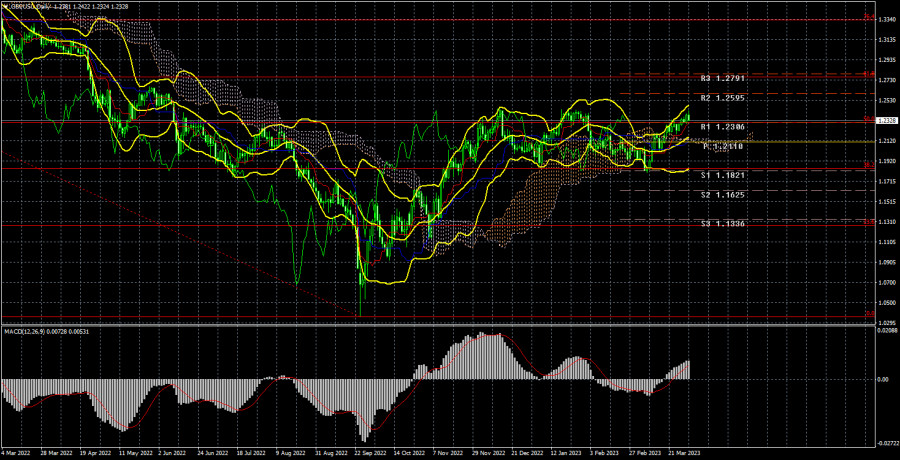

After once more determining the lower boundary of the 1.1840–1.2440 side channel, the GBP/USD currency pair continued to move upward during the current week. The side channel can be used to monitor any local movements; at this point, realizing that the flat continues to exist is crucial. Additionally, if the flat holds, we can't, in theory, anticipate any pattern movements. The pair has been moving toward a target of 1.2440, which we have discussed frequently. On Friday, it reached 1.2420, which can be viewed as working out of the channel's upper limit. We may well anticipate a downward reversal and a movement back to the bottom border of the channel, which is the level of 1.1840, since the movement to the north stopped on Friday. From the perspective of macroeconomic theory, a 500–600 point decline in the value of the pound can also be utterly irrational. But once more: within the side channel, the pair does not require compelling reasons to move in either direction.

These same moves appear very solid, like trends, on the 4-hour TF. As a result, it might appear that the pair is not in the flat. However, let me tell you that flat doesn't just occur on junior TF. As a result, it is essential to begin now on the side channel of the daily TF. It will be feasible to discuss the long-term prospects of the dollar or the pound, as well as the impact of the fundamental background, once the pair have left it. Right now, it doesn't make logical sense. At the beginning of the week, Andrew Bailey gave two performances. The most important point he made to the market was that although the rate will continue to rise due to high inflation, it shouldn't go as high as it did in 2008. His remarks could be read in a variety of ways by traders; they contain both "hawkish" and "dovish" tones. After all, the rate may increase another 1-2 times by 0.25%, and that's it. This will not be sufficient to bring down inflation to 2.9% by the end of the year, and the pound will not benefit from such tightness in the market.

COT evaluation.

COT data for the British pound started to be released on schedule. The most recent update is from March 28. The "Non-commercial" group started 3.3 thousand sell contracts and closed 0.3 thousand buy contracts, according to this report. As a result, although overall growth is continuing, the net position of non-commercial traders has dropped by 3,000. The net position indicator has been rising steadily over the past 7-8 months, but the major players' outlook is still "bearish," and even though the pound sterling is strengthening against the dollar (over the medium term), it is very challenging to explain why from a fundamental standpoint. We utterly do not rule out the possibility that the pound will start to decline more rapidly in the immediate future. Since there hasn't been an increase in the pound for three months, it has officially started, but so far the movement appears to be more flat. Note that both main pairs are currently moving fairly similarly, but that the net position on the euro is positive and even suggests that the upward momentum will soon come to an end, while the net position on the pound is negative, allowing us to predict further growth. However, the pound has already increased by 2,100 points, which is a significant amount, and without a significant downward adjustment, further growth would be completely illogical. The Non-commercial group now has a total of 52 thousand sales contracts and 28 thousand purchase contracts. We continue to be pessimistic about the British pound's long-term development and anticipate a decline.

Analysis of significant events.

This week in the UK, there was just one report that was important to traders. Although most experts were leaning toward expecting negative growth, GDP increased by 0.1% in the fourth quarter. Despite this positive news, the British pound did not experience much market support. However, we should keep in mind that macroeconomics no longer takes precedence over the side channel. In addition, the pound has been rising recently as well as all week until Friday. As a result, such a weak reason to purchase the pound was dismissed. The United States also released a report on GDP for the fourth quarter, with the indicator coming in at 3.9% q/q and 2.6% y/y, which was largely in line with expectations. From a macroeconomic standpoint, the dollar had more cause to rise this week than the pound.

Trading strategy for the week of April 3–7:

1) The pound/dollar pair remains in the side channel between 1.1840 and 1.2440. Because the pair is getting close to its higher limit, short positions are more important right now. It's unlikely that the two will soon emerge from the secondary channel. Since there hasn't been a significant correction following the growth in the second part of last year, the pound may now decline by 500–600 points, if not even more.

2) Purchases won't matter until the price is fixed above the level of 1.2440. Even in this situation, the British pound's development might not be strong. But at least we will have a buy indication if we leave the channel through the upper limit. The pair still needs to move past the 1.1840 level before you can start opening long positions, which could take several weeks.

Explanations for the illustrations:

Fibonacci levels, which serve as targets for the beginning of purchases or sales, and price levels of support and resistance (resistance/support). Take Profit levels may be close by.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

The net position size of each trading group is represented by indicator 1 on the COT charts.

The net position amount for the "non-commercial" group is represented by indicator 2 on the COT charts.