Federal Reserve official Christopher Waller has stated the possibility of lowering interest rates in the coming months, provided that inflation in the United States continues to slow down. According to his statements, this could happen within the next 3-5 months, and such revelations imply increased pressure on the dollar for the markets.

Yields on US Treasuries immediately started to fall, reaching a low of 4.253%, after which bonds of other countries also began to drop. The CME futures market currently anticipates the first rate cut at the May 1st meeting of the Federal Reserve, which roughly aligns with historical trends – after the completion of the tightening cycle, there is typically an average of 8.5 months before the first rate cut. Considering that the Fed last raised rates in June, the end of April to early May approximately aligns with these estimates.

Yields on 5-year Treasury Inflation-Protected Securities (TIPS) closed at 2.15% on Tuesday, marking the lowest level since July. This suggests that business inflation expectations also support further decreases in inflation and align with the earlier stages of the Fed's rate-cutting cycle.

The rise in oil prices has resumed, as markets anticipate an extension of the agreement to reduce oil exports and production under the current conditions from OPEC+ meeting in Vienna. The risks of an oil surplus amid the expected global economic slowdown are too significant for the agreement to be canceled. Simultaneously, there's a small chance that production quotas will be reduced. If the OPEC+ decision aligns with these expectations, it will provide support to commodity currencies.

USD/CAD

The Canadian dollar received some support after the release of stronger-than-expected retail sales data in Canada for September (+0.6% MoM). Sales volumes increased, preliminary data for October showed further strengthening (+0.8% MoM), and August data excluding automobiles were revised up by a tenth.

It is also noteworthy that in Canada, over 400,000 new jobs have been created this year, accompanied by a significant increase in average wages. The country still maintains high home ownership, and unlike the U.S., over 60% of households do not have a mortgage, contributing to the expectation of stable and robust demand. In regards to controlling inflation, these factors complicate the Bank of Canada's task, but from the standpoint of economic stability, they are an obvious plus.

On Thursday, GDP data for the third quarter, as well as for September and October, will be updated, with forecasts suggesting near-zero growth. On Friday, the labor market report may cause increased volatility.

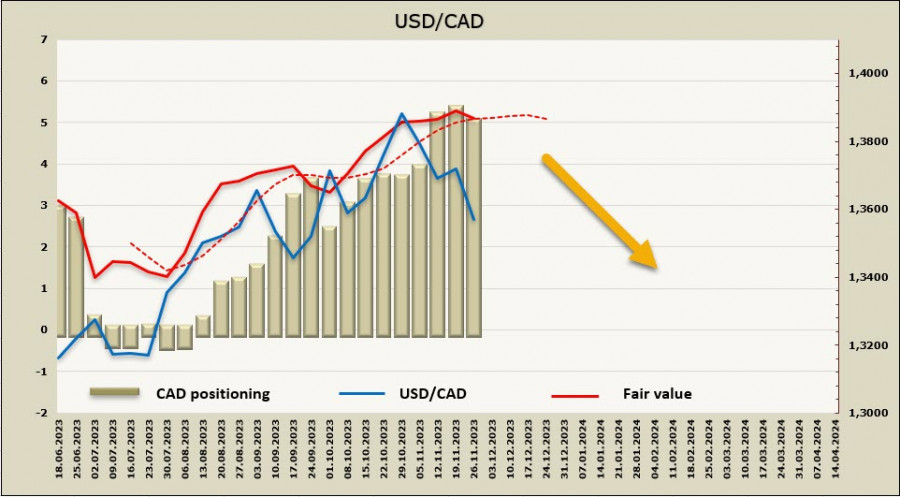

The net short CAD position decreased by 365 million to -4.776 billion during the reporting week. Positioning for the Canadian dollar remains confidently bearish, while the price tries to turn downwards.

A week earlier, we assumed a break above from the consolidation area rather than a break below. However, USD/CAD reacted to the USD's weakness in sync with the market. The likelihood of a downward movement has increased, with support at 1.3494, a technical level. A deeper decline to the local low of 1.3382 is currently unlikely. A possible upward retracement may encounter resistance in the 1.3620/40 area, where selling pressure may resume.

USD/JPY

The Japanese economy remains in expansion territory, despite the threat of a global economic slowdown. Risks primarily lie in a sharp deterioration of the trade balance due to a decline in global demand and a reduction in capital expenditures if the Bank of Japan decides to exit negative interest rate policy.

The core Consumer Price Index remains above 2% YoY, but this is more related to the rise in commodity prices and a weak yen than the stability of domestic demand. In spring 2024, after lengthy negotiations between the government, unions, and employers, a significant increase in wages is planned. However, real wages continue to decline, leading to a reduction in consumer spending.

The BOJ is facing a non-trivial task - how to initiate the process of exiting negative interest rates while maintaining a level of consumer spending sufficient to prevent a return to deflation. The yen's strength will cheapen imports and contribute to a reduction in inflation, rather than stabilizing it at the 2% level. The BOJ has already expressed its intention to end its policy of negative interest rates in April, with the possibility of postponing this step to January or March if conditions require.

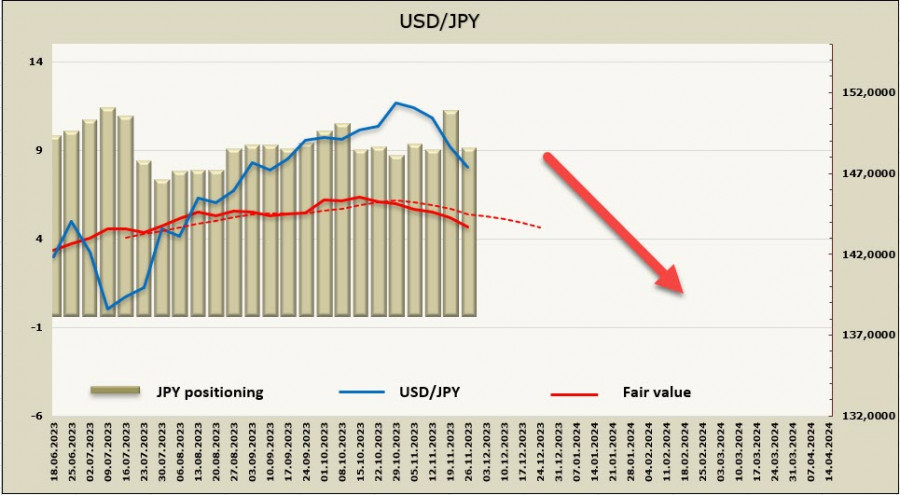

The net short JPY position decreased by 1.944 billion over the reporting week, the second-best among G10 currencies after the euro. The bearish bias remains intact with an overall excess of -8.88 billion. The price is headed downwards, suggesting further decline in USD/JPY.

Trading has entered the lower half of the bullish channel, with the mid-channel of 147.90/148.10 now acting as a resistance area. Attempts to rise may face selling pressure when reaching this zone. The nearest target is the technical level of 145.90, and the long-term target shifts to the lower band of the channel at 143.50/70.