On Friday, the GBP/USD currency pair continued its upward movement and surged sharply. In recent years, we've frequently noted that with nearly identical fundamental conditions, the British pound often strengthens more than the euro. As we can see, this pattern is continuing into 2025. It's difficult to say what is fueling market optimism specifically for the pound. We believe the euro and pound are not inherently meant to show identical volatility, so there's little point in asking, "Why is this happening?" Both European currencies are rising logically — because Donald Trump remains president of the United States, and there is virtually no real chance of his impeachment.

Therefore, the overall fundamental backdrop—which is currently shaped almost exclusively by Trump's actions—remains extremely negative for the dollar. Yes, the dollar continues what is essentially a free fall, while the euro and pound are rising not because the EU or UK economies are booming but because the market now has additional reasons to sell the dollar and, for instance, buy the pound—and it does so accordingly.

Last week, it was reported that inflation in the UK jumped to 3.5%. That's nearly a 1% increase in a single month. Interestingly, the Bank of England lowered its key interest rate just a week prior. Andrew Bailey and other officials from the Bank of England had warned for some time that inflation would increase because of Trump's tariffs. Despite these warnings, they chose to cut interest rates anyway. It's difficult to determine now whether this decision was justified. But the market can now reasonably assume that the next rate cut will not come anytime soon.

As a result, in the near term, the BoE — like the Federal Reserve — will maintain a "hawkish" stance. However, unlike the Fed's tone, which the market currently disregards, the BoE's positioning is an additional factor in favor of buying the GBP/USD pair. So why not take advantage of it? The euro doesn't have such a "supporting factor," as the European Central Bank continues easing monetary policy and may even lower its key rate below neutral. The ECB is seriously concerned about the state of the economy, which could deteriorate further amid the ongoing trade war with Trump. And if the U.S. president raises tariffs again on June 1, the EU economy could suffer greatly.

Thus, the ECB is expected to continue cutting rates while the British pound has some protection. The UK and U.S. have signed a trade agreement — which, at this point, remains Trump's only deal. The deal is extremely crude; most tariffs are still in place, and no one has even seen the actual document. Nevertheless, this factor allows the British currency to outperform the euro.

In summary, the fundamental background again turns toward "sell the dollar and flee the U.S." The signs of de-escalation we saw over the past month and a half turned out to be empty gestures. The British pound couldn't — or didn't want to — correct even during the calm period when tariff headlines were absent.

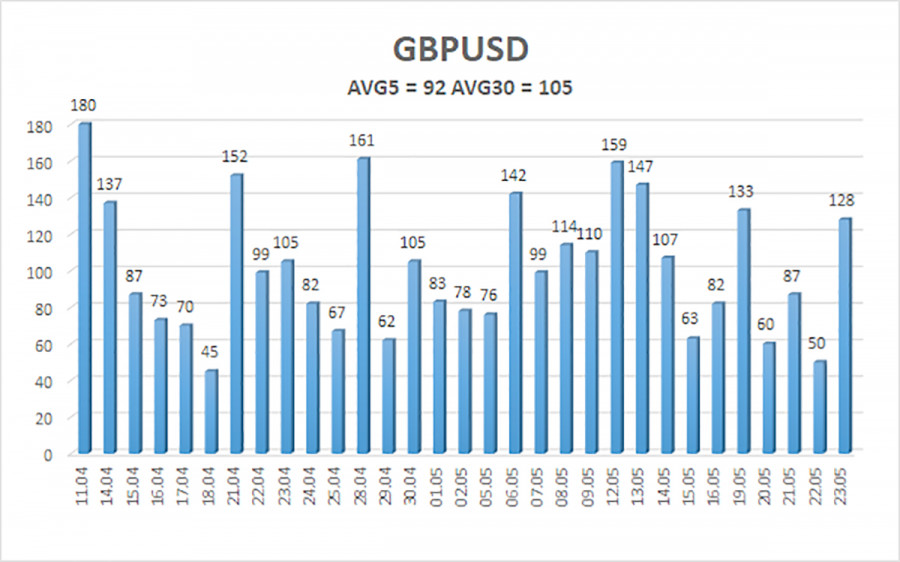

The average volatility of the GBP/USD pair over the last five trading days stands at 92 pips, which is considered "average" for this pair. Therefore, on Monday, May 26, we expect movement within a range defined by the levels 1.3444 and 1.3628. The long-term regression channel is directed upward, indicating a clear bullish trend. The CCI indicator has not recently entered extreme zones.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading Recommendations:

The GBP/USD pair maintains its upward trend and continues to rise regardless of broader conditions. The brief phase of trade conflict de-escalation came and went, but the market's aversion to the dollar remains. Therefore, long positions remain viable, with targets at 1.3550 and 1.3628. A breakdown below the moving average line would allow for short positions with a target of 1.3306. From time to time, the U.S. currency may show minor corrections. Further upside will require new, concrete signs of real de-escalation in the global trade war.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.