was formed on 05.06 at 16:45:18 (UTC+0)

signal strength 2 of 5

signal strength 2 of 5

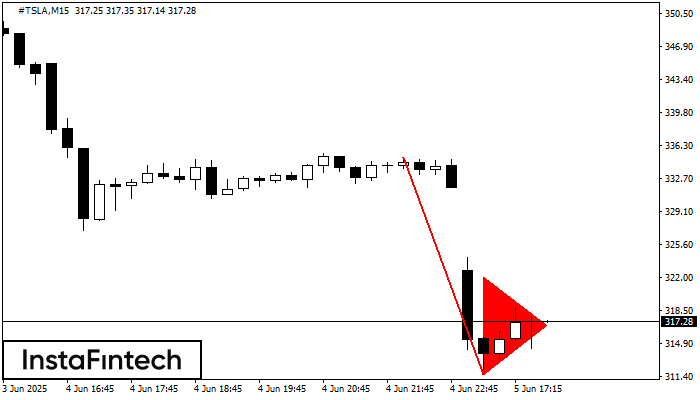

The Bearish pennant pattern has formed on the #TSLA M15 chart. This pattern type is characterized by a slight slowdown after which the price will move in the direction of the original trend. In case the price fixes below the pattern’s low of 311.59, a trader will be able to successfully enter the sell position.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength