Markets were shaken with the release of the JOLTS report, as job openings in the U.S. rebounded to 9.61 million in August from 8.92 million in July, against forecasts of a decline to 8.8 million. Prior to this, a gradual decline in job openings had been observed in 6 out of the last 7 months, indicating a gradual recovery in the labor market. But now forecasts need to be revised, as the slow recovery in the labor market increases the chances of the Federal Reserve keeping interest rates high for an extended period.

The unexpected surge in job openings exerted strong pressure on the bond market, with 10-year UST yields briefly rising to 4.887%, after which yields increased across the spectrum of global bonds. The rise in UST yields supported the dollar, which remains as the world's dominant reserve currency.

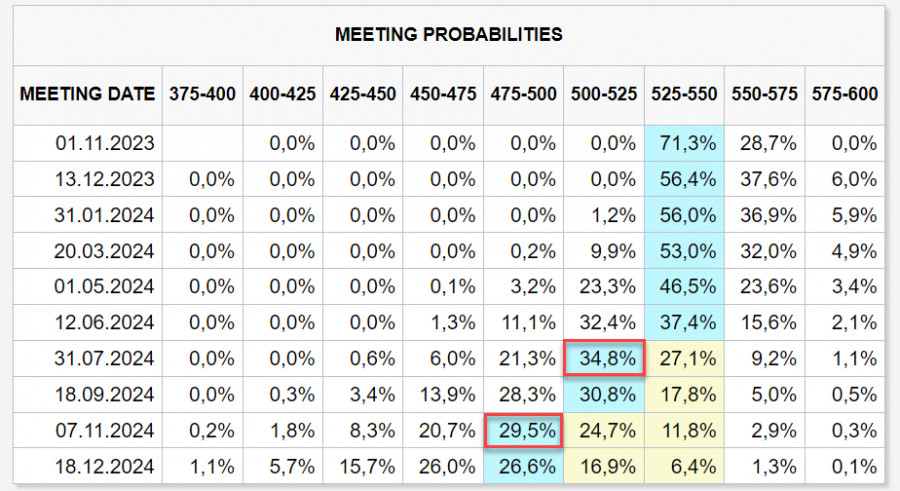

At the same time, the Fed rate forecast remained unchanged, with the CME futures market seeing two rate cuts next year – in July and November.

If Friday's non-farm payrolls report confirm the trend of a stronger labor market, it could lead to a reassessment of expectations for the Fed's interest rates in favor of a longer period of high rates, giving the dollar another argument in favor of extending its rally.

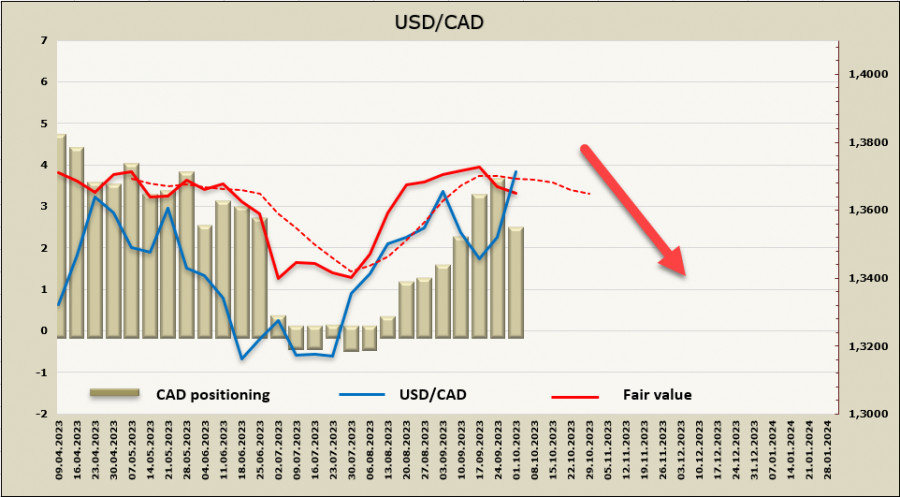

USD/CAD

On Friday, Canada will update its labor market indicators for September. The data will contribute to a better understanding of the Bank of Canada's stance ahead of the October 25 meeting. Relatively high level of job openings and rapid population growth due to migration could be the reason for another strong report, which would further change the odds in favor of another rate hike.

The Canada Manufacturing PMI fell to a seasonally adjusted 47.5 in September from 48.0 in August, and the retail sales report will be released on Thursday.

The net short CAD position unexpectedly fell by 1.2 billion to -2.4 billion during the reporting week. The CAD bias is bearish, and the price is trying to move even further below the long-term average, increasing the chances of a decline.

The pair has tested the upper band of the range, but it remains unclear whether the current movement will continue. There are several factors at play; the price points to a decline in the loonie, but the USD's dominance in the currency market is pushing the pair higher. It is more likely for the pair to return to the middle of the range at 1.3310/30, but if the market becomes convinced that the Fed will maintain high rates for a longer period, USD/CAD will move higher toward 1.3860.

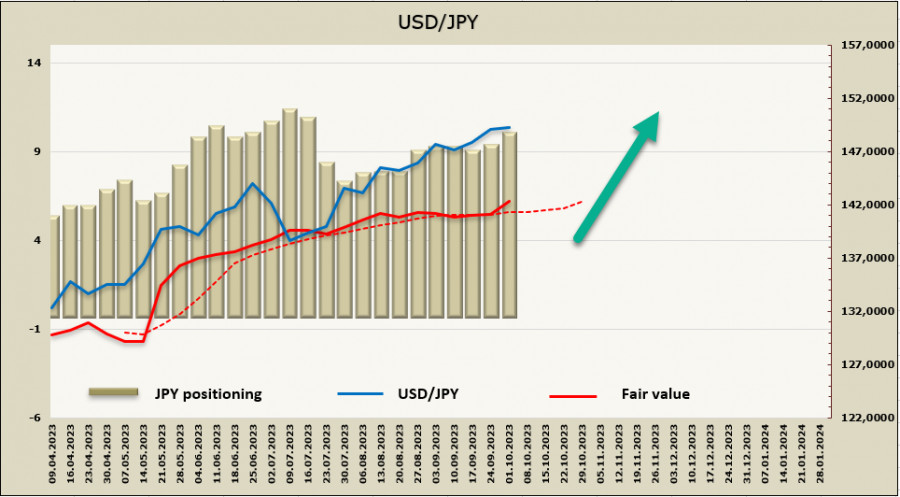

USD/JPY

Japanese policymakers continue to comment on the yen's situation. Finance Minister Shunichi Suzuki said he had a strong sense of urgency about the yen, but has not set a line of defense and is instead focused on the pace of currency movement. Currency markets are still prepared for interventions as the USD/JPY pair has once again tested the psychological level of 150. The Bank of Japan conducted an emergency bond purchase on Wednesday, as the yield on 10-year JGBs reached new cycle highs around 0.77%, but so far, the volumes remain small.

The Tankan business survey for the third quarter turned out even stronger than expected, with sentiment among large non-manufacturing companies at its highest level since the early 1990s. The index for large manufacturers increased from 5 to 9, surpassing expectations. Corporate spending plans remain stable, and 3- and 5-year inflation expectations remain unchanged above 2%.

Strong business sentiment will be crucial for potential wage increases in the economy next year, which is a prerequisite for the BOJ to normalize its policy. A summary of opinions at the BOJ's September meeting showed that policymakers discussed the prospects of an eventual exit from ultra-loose policy. One member said the second half of the current fiscal year, ending in March 2024, will be an "important period" in determining whether the price stability target will be achieved.

The net short JPY position increased by 0.6 billion to -9.2 billion over the reporting week, with the bearish bias intact and the price trading above the long-term average, moving higher.

All signs suggest that the pair will continue to rise unless Japanese authorities start currency interventions. On Tuesday, USD/JPY experienced a sharp bearish correction with a gap, which closely resembled intervention, but no official statements followed. While potential intervention may temporarily strengthen the yen, it is unlikely to change the overall trend of currency depreciation as long as yield spreads continue to widen.

In the current conditions, fundamental factors clearly point to an upward movement, and the 151.91 target is getting closer.