Analysis of Trades and Trading Tips for the Japanese Yen

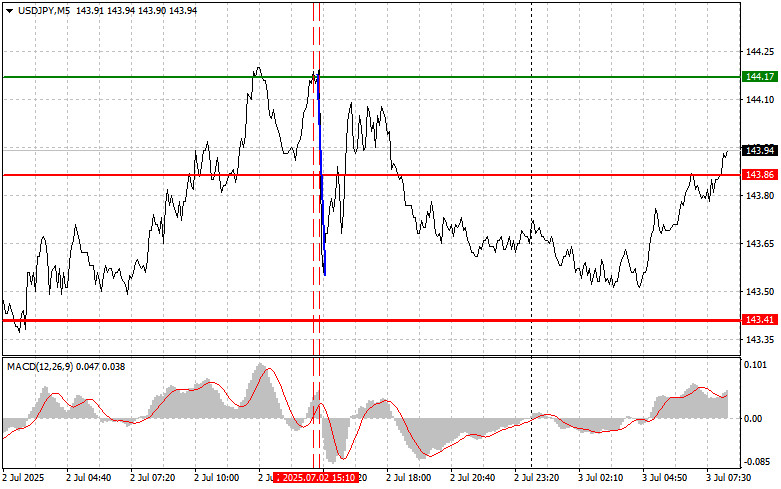

The first test of the 144.17 price level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the dollar's upside potential. For this reason, I did not buy the dollar. The second test of 144.17 occurred when the MACD was in the overbought zone, enabling Sell Scenario #2 to be executed. As a result, the pair declined by more than 50 points.

Yesterday's ADP report, which showed a sharp drop in employment, led to a rapid sell-off of the U.S. dollar and a strengthening of the Japanese yen. Alarmed by the unexpected employment decline, investors rushed to offload dollar assets in favor of safer havens, with the yen emerging as a primary beneficiary. The Japanese currency is traditionally seen as a safe haven during times of economic uncertainty. The drop in risk appetite triggered by weak U.S. employment data exacerbated existing fears of a global economic slowdown. As a result, many investors rebalanced their portfolios, reducing exposure to risk assets and increasing their holdings of more conservative instruments.

Today's data on the growth of Japan's services PMI failed to support the yen, raising questions about the further decline of the USD/JPY pair. The market appeared to be expecting more convincing signs of recovery that could justify further monetary tightening by the Bank of Japan. The pair's further direction will depend on U.S. labor market data, which will be released later today. We'll return to this in the forecast for the U.S. session.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Buy Scenario

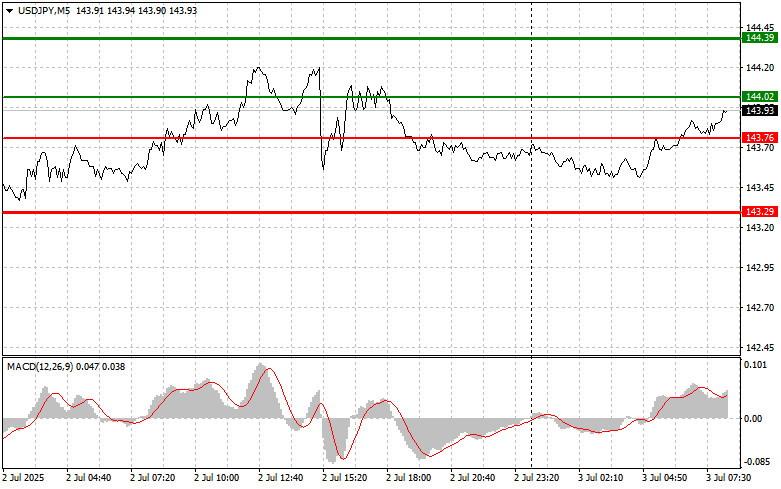

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point at 144.02 (indicated by the green line on the chart) with a target of 144.39 (denoted by the thicker green line on the chart). Around 144.39, I intend to exit long positions and open short ones (expecting a 30–35-point reversal). Buying the pair is best done on corrections and significant pullbacks of USD/JPY.

Important: Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of the 143.76 level while the MACD is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. A rise to the opposite levels of 144.02 and 144.39 can be expected.

Sell Scenario

Scenario #1: I plan to sell USD/JPY today only after breaking below the 143.76 level (red line on the chart), which would lead to a quick decline in the pair. The sellers' key target will be 143.29, where I intend to exit short positions and open long ones immediately (expecting a 20–25-point reversal). Downward pressure on the pair may return quickly today.

Important: Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY if there are two consecutive tests of the 144.02 level while the MACD is in the overbought zone. This will cap the pair's upside potential and trigger a downward reversal. A decline to the opposite levels of 143.76 and 143.29 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.