The EUR/USD currency pair remained completely calm throughout Wednesday. Let's recall that this week began with a storm, provoked—of course—by Donald Trump, who first announced a ceasefire between Iran and Israel and then spent the entire day trying to "separate the two." However, a fragile peace had been established by the end of the day. How long it will last remains an open question. But does it matter for the U.S. dollar, which has been falling for five consecutive months, ignoring even the rare positive factors?

Historically, monetary policy has always been the most influential factor in any currency's exchange rate. But in 2025, this pattern is no longer working. Once again, let us remind you that the Federal Reserve has not lowered the key interest rate even once this year, unlike the European Central Bank (which has done so four times) and the Bank of England (twice). Due to high inflation, the British central bank might now pause, and the ECB no longer needs to continue easing monetary policy, as inflation in the Eurozone has slowed considerably. But that is the situation now. What about the past five months?

It could be said that Trump has achieved the nearly impossible. He managed to drive the dollar down by 15 cents in a short time without demonstrating any positive economic developments. Perhaps in the future, trade deals will be signed with all members of the "blacklist." Perhaps the U.S. economy will begin to show signs of recovery by year-end. However, our analysis focuses on the current macroeconomic indicators, which offer nothing promising for the U.S. economy.

In light of a new tariff and trade policy, the Fed refuses to lower the key interest rate, prompting Trump to express his anger. The U.S. President wants to shift the blame for the economic slowdown and any potential problems onto the Fed. The argument goes: "If they had listened to me, there would be no slowdown or inflation." However, the Fed, led by Jerome Powell, is only willing to take responsibility for its own actions. If the American central bank spent several years fighting high inflation, and then Trump came to power and began working against the Fed's goals, why should Powell and his colleagues break their heads trying to solve this problem?

If the Fed resumes monetary easing, inflation will be able to accelerate more easily. In the first three months of Trump's tariffs against practically everything on the planet, there was no significant rise in the Consumer Price Index. But presumably, the Fed employs professional economists who earn their salaries for good reason. And they are indeed forecasting an acceleration of inflation this summer. That's why Powell does not intend to lower the rate—though this cannot be his decision, unlike Trump, who seems to have forgotten about the existence of Congress. Powell addressed Congress directly on Tuesday and again on Wednesday. We didn't hear anything new, and there was nothing for the markets to respond to. The euro once again updated its three-year highs, but the technical picture does not suggest the end of the uptrend.

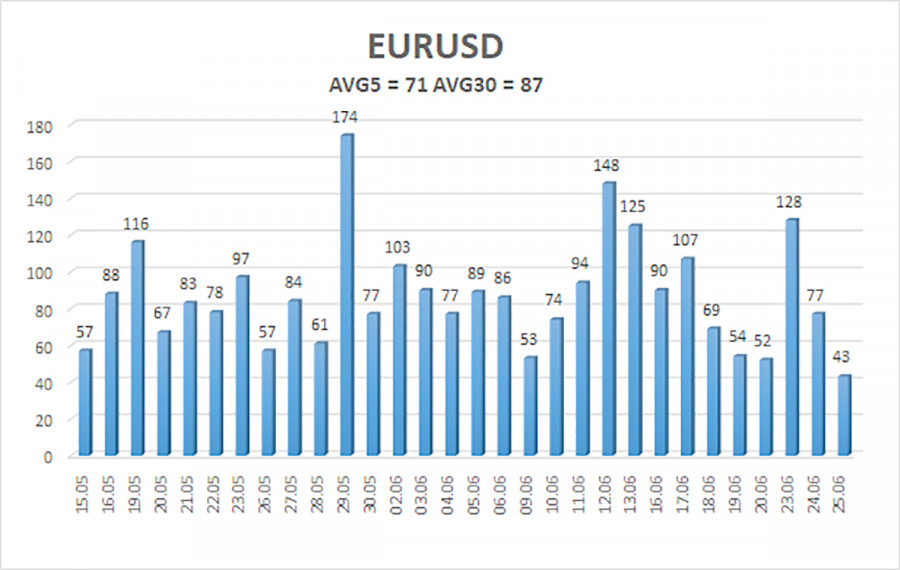

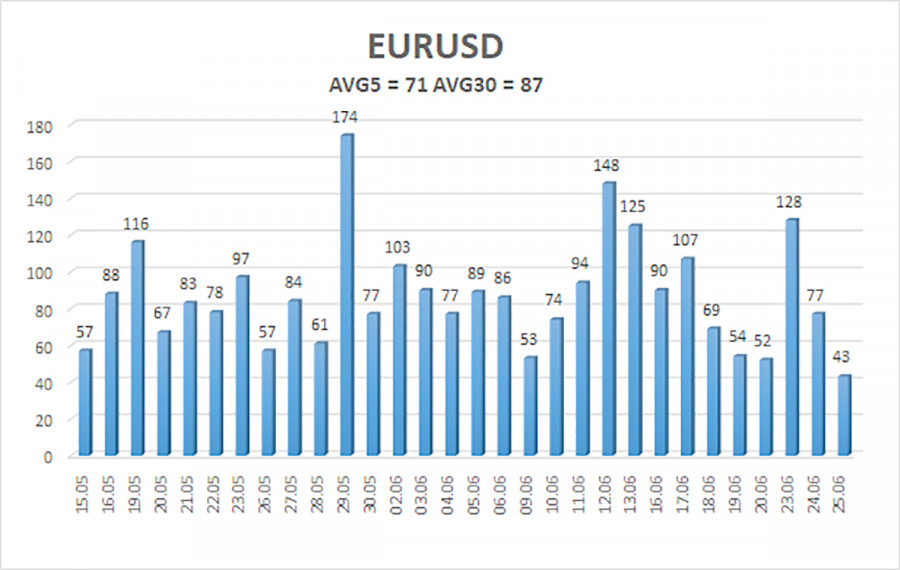

The average volatility of the EUR/USD pair over the past five trading days, as of June 26, is 71 pips—characterized as "moderate." We expect the pair to move between the levels of 1.1564 and 1.1706 on Thursday. The long-term regression channel is pointed upward, indicating the trend remains bullish. The CCI indicator entered the overbought zone, which again triggered only a minor downward correction.

Nearest Support Levels:

S1 – 1.1597

S2 – 1.1475

S3 – 1.1353

Nearest Resistance Levels:

R1 – 1.1719

R2 – 1.1841

R3 – 1.1963

Trading Recommendations:

The EUR/USD pair continues its upward trend—Trump's policies—both domestic and foreign—remain the primary driver influencing the U.S. dollar. In addition, the market often interprets economic data unfavorably for the dollar or ignores it altogether. We still observe a complete unwillingness among market participants to buy the dollar under any circumstances.

If the price is below the moving average, short positions remain relevant with targets at 1.1475 and 1.1353, though a significant downside is unlikely under the current conditions. If the price is above the moving average, long positions with targets at 1.1706 and 1.1719 can be considered part of the trend continuation.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.