The EUR/USD currency pair traded extremely calmly on Monday, considering the intense fundamental backdrop that developed over the weekend. Recall that over the weekend, Donald Trump once again "changed his mind" and ordered an unexpected strike on three of Iran's nuclear facilities. As expected, the U.S. President claimed that all three sites were completely destroyed, while Iran reported that the American bombs inflicted no significant damage. Regardless, this marked another escalation in the Middle East conflict—one in which the United States is now openly involved.

Because of this, sharp volatility in either direction was expected on Monday. As noted earlier, such a military escalation should theoretically support the U.S. dollar, yet two previous escalations failed to deliver meaningful dollar strength. Moreover, earlier events did not involve direct U.S. engagement, whereas now, America is one of the direct parties in the conflict. Can the dollar still be viewed as a "safe haven" under these circumstances—especially when traders had already stopped seeing it that way before Saturday's events?

The dollar did strengthen overnight as markets opened on Monday, but by the time the European session began, it had already lost all its gains. In the second half of the day, news emerged that Iran had launched a missile strike on a U.S. military base in Syria, and Iranian Deputy Foreign Minister Majid Takht-Ravanchi announced that Iran was exiting negotiations with the U.S. and Israel. If anyone hoped for a quick resolution to the conflict, it now seems unlikely. The dollar plunged in response.

Many analysts have long pointed out a simple truth: If Iran were willing to give up its nuclear program, it would have done so already. The fact that it hasn't suggests the program is seen as its primary means of defense—or even offense. Iran has lived under global sanctions for nearly 50 years yet continues its nuclear development undeterred. Trump's logic in targeting these facilities is understandable—but what does he hope these strikes will change?

Iran has long been building its critical infrastructure underground, especially facilities that could become "priority targets" in the event of war. While such bunkers can still be destroyed, the chances of success are much lower. At present, no one can say with certainty whether the targeted facilities were actually destroyed. Naturally, Trump had to declare "total victory," while Iran insists the targets were not fully hit. Thus, the conflict that Trump hoped to resolve has instead flared up with renewed intensity—making it the second major conflict he tried and failed to settle. Both sides will likely continue exchanging strikes, yet the dollar still cannot capitalize on the situation.

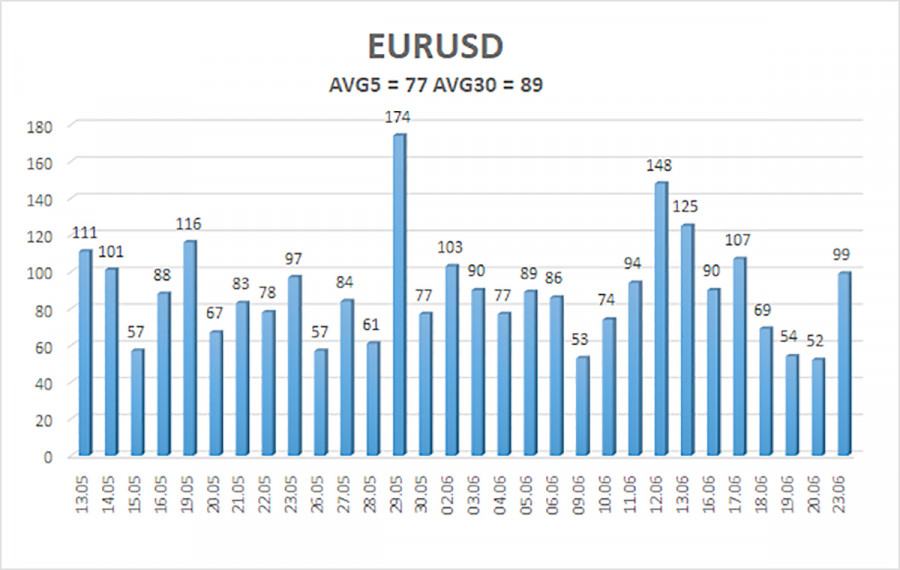

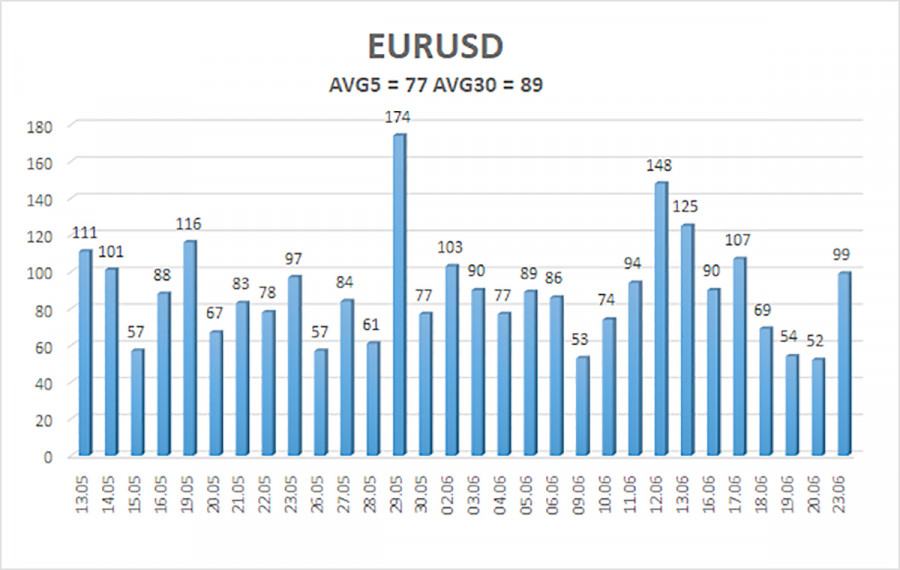

The average volatility of the EUR/USD pair over the last five trading days as of June 24 is 77 pips, which is considered "moderate." On Tuesday, we expect the pair to trade between 1.1460 and 1.1614. The long-term regression channel is still pointed upward, indicating a continuing uptrend. The CCI indicator entered the overbought zone, triggering only a modest downward correction.

Nearest Support Levels:

S1 – 1.1475

S2 – 1.1353

S3 – 1.1230

Nearest Resistance Levels:

R1 – 1.1597

R2 – 1.1719

R3 – 1.1841

Trading Recommendations:

The EUR/USD pair remains in an upward trend. The U.S. dollar continues to be heavily influenced by Trump's domestic and foreign policy. Additionally, the market often interprets data against the dollar or ignores it. There's a clear reluctance among market participants to buy the dollar under any circumstances. If the price trades below the moving average, short positions with targets at 1.1446 and 1.1353 are justified—but significant declines shouldn't be expected in the current environment. If the price remains above the moving average, long positions targeting 1.1597 and 1.1614 may be pursued as part of the ongoing trend.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.