All key components of the UK labor market report were either in the red zone or matched the forecast, confirming the pessimistic expectations of analysts. The report gave no joy to GBP/USD buyers, and as a result, the price dropped by nearly 100 points to the 1.3455 mark. Nonetheless, another important point must be noted: despite this downward impulse, the support level of 1.3450 (the middle line of the Bollinger Bands on the D1 timeframe) held firm due to the weakening US dollar index. Therefore, it's too early to rush into selling the pair—despite the pressure on the pound on Tuesday, the pair remains afloat.

Still, the release holds significant weight for the British currency and will resurface next week on June 19, during the Bank of England's next policy meeting.

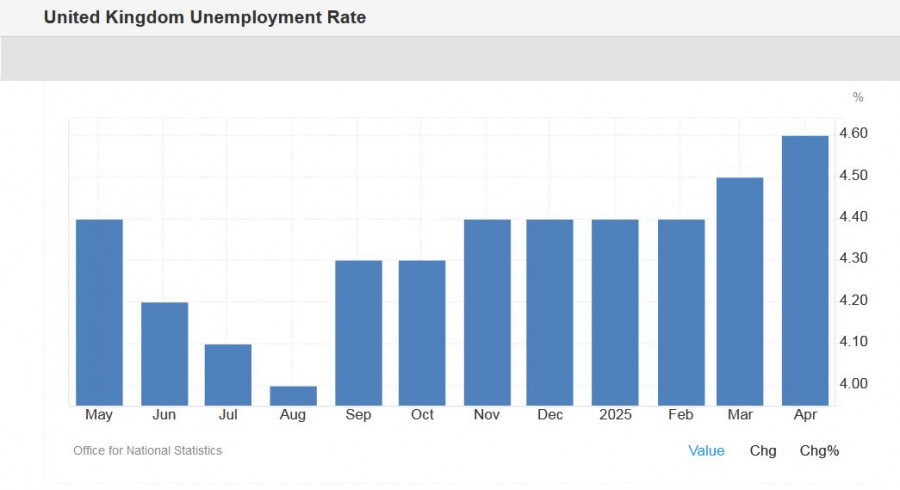

According to the published data, the UK unemployment rate rose to 4.6%. While this matches the forecast, it marks a nearly four-year high—the last time the unemployment rate was at this level was in September 2021. Moreover, an upward trend is gradually forming: for four consecutive months (November to February), the rate was 4.4%; in March, it rose to 4.5%; and now, in April, it reached 4.6%.

More timely data was also disappointing. In particular, the number of jobless claims in May jumped by 33,000 (the highest level since August of last year), whereas the forecast was for a rise of just 9,000. In the previous month, the indicator had fallen by 21,000.

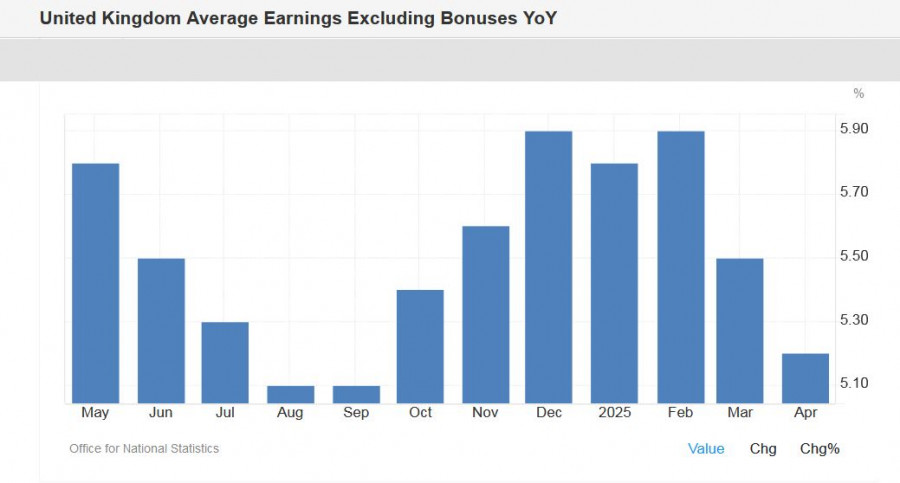

Most importantly, wage growth slowed in May. The average earnings growth rate (including bonuses) dropped to 5.3% (forecasted to decline to 5.5%). Excluding bonuses, wages also fell to 5.2% from the previous 5.5%. On the one hand, this is a modest decrease. On the other hand, the downward trend itself is what matters here.

Why is this important? It's worth recalling BoE Governor Andrew Bailey's remarks to the House of Commons in early June. He effectively "linked" wage growth to the pace of interest rate cuts. The central bank chief noted that according to the BoE's forecasts, wage growth will slow this year, and "this will be crucial for future rate decisions." The implication here is more than clear.

Given Bailey's stance, it can be assumed that at the upcoming meeting next week, the central bank will significantly soften its tone and likely announce another round of monetary policy easing soon.

According to a Reuters poll, the majority (52 out of 59) of economists believe the BoE will cut rates twice this year—by 50 basis points. The first cut is expected in Q3 (i.e., at the August meeting), and the second in Q4 (one of the remaining three meetings of the year). This would bring the rate down to 3.75% before the start of 2026.

Some analysts skeptical of this scenario point to the April rise in UK inflation, arguing that this fundamental factor could prevent the BoE from easing policy. However, the inflation spike in April was mainly due to increased road tax. Significant changes in the Vehicle Excise Duty (VED) system came into force on April 1, affecting both traditional internal combustion engine cars and electric vehicles (previously exempt). An additional charge now also applies to vehicles valued over £40,000.

According to several experts, the VED hike's effects will be reflected in April–May inflation readings (as many drivers pay the tax annually), but the impact will fade afterward. Thus, the BoE will likely focus more on slowing wage growth than the CPI acceleration.

Why did GBP/USD sellers respond so modestly to the report? Bears couldn't even break through the intermediate price barrier at 1.3450 (the middle line of Bollinger Bands on D1), let alone achieve more meaningful targets.

The reason is the weak greenback, which continues to lose ground across the market. The news vacuum surrounding the US-China trade negotiations in London is working against the US dollar. The talks are on their second day, but no details or leaks have emerged. Despite optimistic, generic statements from Trump and US negotiators (along the lines of "everything is going well"), the dollar is retreating, thereby supporting GBP/USD buyers.

However, it's advisable to open positions only after the talks conclude and official statements are made. Cautious remarks or the absence of a unified position would weaken the greenback—GBP/USD buyers may try to hold above the 1.36 handle and test resistance at 1.3650 (upper Bollinger Band on D1). If, however, the negotiations result in progress (e.g., concrete steps toward de-escalation), GBP/USD sellers will take the lead again. In that case, the pair will decline due to pound weakness and dollar strength. Likely, bears would then not only break the 1.3450 support but also aim for the 1.33 handle.

The situation remains uncertain and may change at any moment (talks could end on Tuesday or be extended), so it is advisable to stay out of the market for now.