Trade Review and Tips for Trading the Japanese Yen

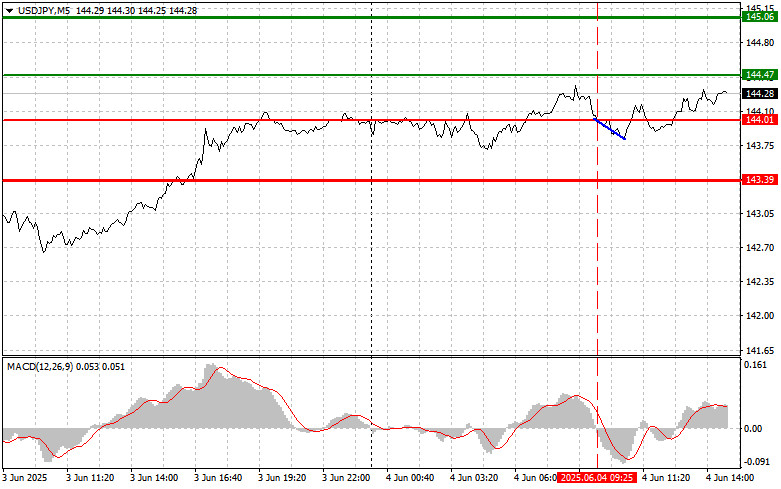

The price test at 144.01 in the first half of the day occurred when the MACD indicator had just started moving downward from the zero mark, confirming an entry point for selling the dollar, although the pair did not achieve a significant drop.

There is clearly insufficient demand for yen buying at current levels, despite strong PMI data for Japan. Most attention is likely focused on the upcoming ADP labor market report in the U.S. and the May PMI figures for the services and composite sectors. These economic indicators can instantly sway market sentiment toward optimism or pessimism depending on how closely the actual numbers match the forecasts.

Top priority is given to labor market conditions. A substantial rise in employment in the ADP report would bolster confidence in U.S. economic stability. Conversely, disappointing figures could signal a slowdown in economic growth and force the Fed to reconsider its plans for maintaining current interest rate levels. The PMI indexes are equally important, reflecting the sentiment of purchasing managers in key economic sectors and providing insights into current business activity. An increase in these indexes indicates economic expansion, while a decline points to contraction.

The day will conclude with speeches by FOMC members Raphael Bostic and Lisa D. Cook. Their comments on the current economic situation and future monetary policy will be closely analyzed by investors for hints about the Fed's next steps. Given persistent inflation and a strong labor market, any signals about possible tightening or easing of policy could cause significant volatility in currency markets.

For intraday strategy, I will mainly rely on the execution of scenarios #1 and #2.

Buy Signal

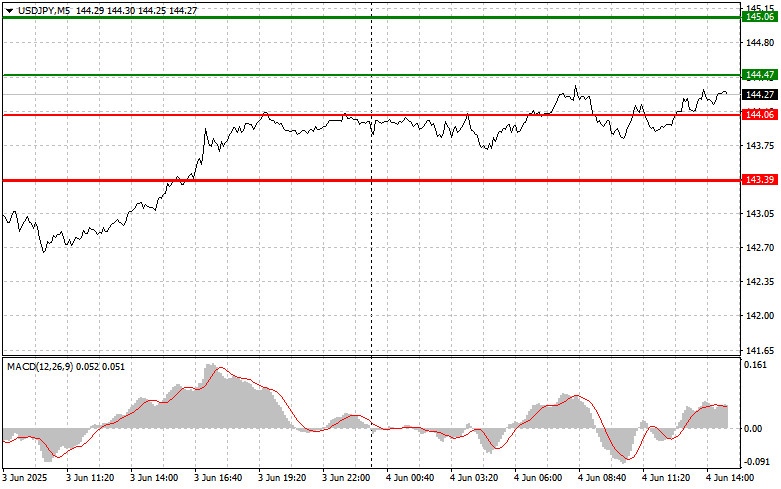

Scenario #1:Today, I plan to buy USD/JPY at the entry point around 144.47 (green line on the chart), targeting a rise to 145.06 (thicker green line on the chart). Around 145.06, I plan to exit long positions and open sell positions in the opposite direction, aiming for a 30–35 point pullback. A strong rise in the pair today is expected only after positive U.S. statistics.Important! Before buying, make sure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2:I also plan to buy USD/JPY today in case of two consecutive tests of the 144.06 level when the MACD is in oversold territory. This will limit the pair's downward potential and lead to a market reversal upward. Growth can be expected toward the opposite levels of 144.47 and 145.06.

Sell Signal

Scenario #1:Today, I plan to sell USD/JPY after the 144.06 level is updated (red line on the chart), which should quickly push the pair lower. The key target for sellers will be 143.39, where I will exit short positions and immediately open long positions in the opposite direction, aiming for a 20–25 point pullback. Pressure on the pair will return if the U.S. statistics are weak.Important! Before selling, make sure that the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2:I also plan to sell USD/JPY today in case of two consecutive tests of the 144.47 level when the MACD is in overbought territory. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 144.06 and 143.39 can be expected.

What's on the Chart:

- Thin green line – entry price where you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or manually lock in profits, as further growth above this level is unlikely;

- Thin red line – entry price where you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or manually lock in profits, as further decline below this level is unlikely;

- MACD Indicator – When entering the market, it is important to follow overbought and oversold areas.

Important:Beginner Forex traders must be very cautious when deciding to enter the market. It is best to stay out of the market before the release of major fundamental reports to avoid sudden price swings. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not practice proper money management and trade with large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.