Trade Analysis and Advice on the Euro

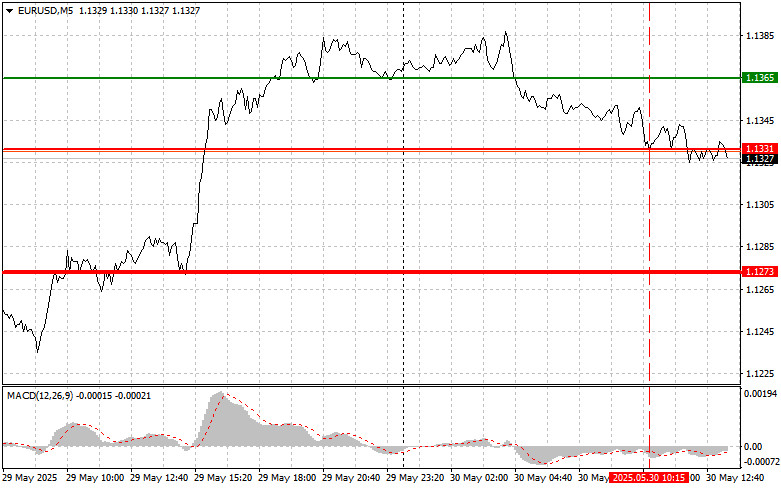

The price test at 1.1331 occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I did not sell the euro.

The single European currency showed a slight decline in response to disappointing German retail sales data. Poor performance in German retail, a key barometer of consumer spending, raised concerns about slowing economic growth in the eurozone's leading economy. This negatively affected the euro. However, stronger-than-expected lending data within the eurozone supported the euro's exchange rate. The increase in lending indicates ongoing economic activity and confidence from businesses and consumers.

In the second half of the day, the key U.S. Personal Consumption Expenditures (PCE) Price Index report is expected, which will significantly influence the Federal Reserve's future strategy on interest rates. This report will serve as an indicator of the effectiveness of the Fed's inflation-containment measures and will help determine the regulator's future course. Additionally, market reaction will depend not only on the figures themselves but also on how closely they align with expert expectations. Any deviation from forecasted values, especially if inflation is higher, could trigger significant volatility in the currency market. Therefore, investors are advised to exercise caution and be prepared for potential volatility, closely monitoring Fed officials' comments following the report's release.

As for the intraday strategy, I will mainly rely on the implementation of Scenario #1 and Scenario #2.

Buy Signal

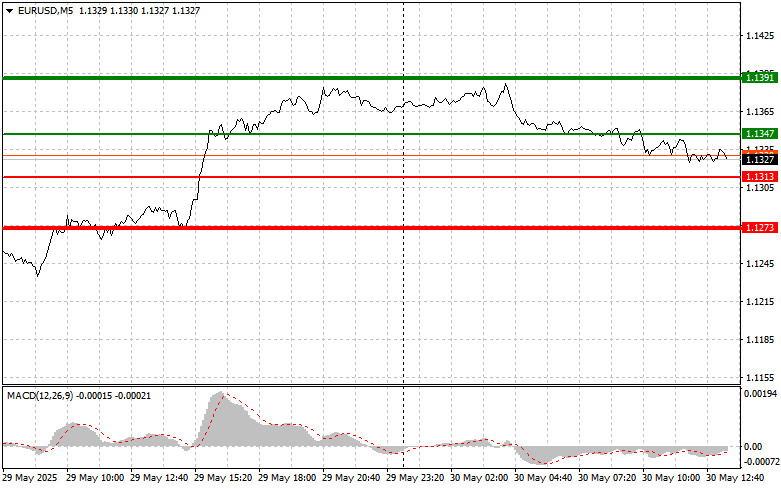

Scenario #1: Today, buying the euro is possible when the price reaches around 1.1347 (green line on the chart) aiming for a rise to 1.1391. I plan to exit the market at 1.1391 and also sell the euro in the opposite direction, targeting a move of 30–35 points from the entry point. Euro growth today can be expected only after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1313 level when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a reversal upward. A rise to the opposite levels of 1.1347 and 1.1391 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1313 level (red line on the chart). The target will be 1.1273, where I plan to exit the market and immediately buy in the opposite direction, targeting a move of 20–25 points in the opposite direction from the level. Pressure on the pair may return today after the statistics. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1347 level when the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a downward reversal. A decline to the opposite levels of 1.1313 and 1.1273 can be expected.

On the Chart:

- Thin green line – the entry price at which you can buy the trading instrument;

- Thick green line – the approximate price where you can set Take Profit or fix profits manually, as further growth beyond this level is unlikely;

- Thin red line – the entry price at which you can sell the trading instrument;

- Thick red line – the approximate price where you can set Take Profit or fix profits manually, as further decline beyond this level is unlikely;

- MACD Indicator: When entering the market, it is important to rely on overbought and oversold areas.

Important: Beginner Forex traders must be very cautious in making market entry decisions. It's best to stay out of the market before the release of major fundamental reports to avoid sharp price fluctuations. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

And remember, to trade successfully, you must have a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are an inherently losing intraday trader strategy.