Today, the EUR/USD pair is testing the resistance level of 1.1090, which corresponds to the middle line of the Bollinger Bands indicator on the D1 timeframe. Overcoming this price barrier will open the path not only to 1.1100 but also, in the long term, to the 1.1200 level.

Key events of the week did not favor the dollar bulls, nor the EUR/USD sellers. On the other hand, the euro survived the September ECB meeting, the results of which were not as dovish as expected, despite the actual rate cut. However, the main reason for the pair's rise is the weakness of the greenback. The European currency wouldn't have been able to climb without the help of the dollar. A significant factor contributing to this weakness was the US presidential debates held this week. This time, Donald Trump didn't become an ally of the US dollar for a simple reason: he lost the verbal battle with Kamala Harris.

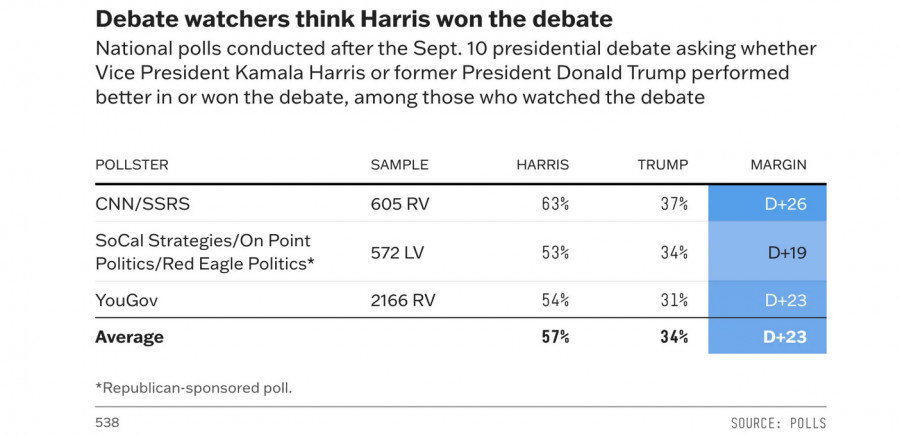

Several days have passed since the debates, and pollsters and journalists have already conducted relevant studies, so now we can refer to numbers rather than subjective assessments.

As mentioned above, the results of the debates were not in favor of the Republican. Three different polls, conducted right after the event, indicated a clear victory for Kamala Harris. Specifically, CNN reported that nearly two-thirds (63%) of respondents named her the undisputed winner. According to SoCal Strategies/On Point Politics/Red Eagle Politics, 53% of those surveyed also declared her the winner. Similar figures (54%) were provided by the YouGov polling service.

These are national survey results. However, it's important to consider the specifics of the American electoral system and its overall ecosystem. In the US, once voters make up their minds, they are unlikely to switch party allegiance. The main battle is for the votes of undecided citizens. Given the nature of the electoral system, candidates are vying for the votes of swing-state voters.

Kamala Harris won in this area as well, at least according to a study by the influential newspaper The Washington Post journalists selected 25 undecided voters from swing states and surveyed them before and after the debates. Twenty-three of the 25 respondents said Harris performed better, and only two expressed a preference for Donald Trump following the debates.

Moreover, Kamala convinced five potential voters to fully support her and even persuaded two potential Republican voters to lean toward voting for her instead. Trump, on the other hand, lost three potential voters.

Trump's defeat was also reflected in the currency market dynamics. While it's not fair to say the debates were the key factor in the dollar's decline, they certainly played a role.

Interestingly, following the previous debates with Joe Biden, the US dollar significantly strengthened across the market. The prospect of increased inflationary protectionist measures, heightened geopolitical risks, and a new trade war with China—such possibilities under a "second Trump presidency"—raised risk aversion in the markets, which helped the dollar strengthen in all major currency pairs. This was despite Trump stating in an interview that the strengthening of the national currency negatively impacts the competitiveness of American exports. Yet, the dollar ignored his warnings.

It cannot be said that the results of the U.S. presidential election are determined following the debates. However, at this stage of the race, doubts about Harris's ability not only to stand up to Donald Trump but also to defeat him have disappeared. It turns out Kamala is not Joe, and Trump remains the same Trump. This formula did not work in the Republican's favor—and, accordingly, not in favor of the dollar bulls. EUR/USD sellers did not receive support and shifted to wait for the results of the September Federal Reserve meeting.

Political fundamental factors typically have a short lifespan. Therefore, in the foreseeable future, the direction of the EUR/USD price will depend not on the election battles in the US, but on the Federal Reserve's position.

From a technical standpoint, the EUR/USD pair is testing the resistance level of 1.1090 (the middle line of the Bollinger Bands on the daily chart). Long positions should only be considered once the price breaks above this barrier, surpassing the middle line of the Bollinger Bands and all lines of the Ichimoku indicator, which will form a bullish Line Parade signal. The target for the up movement is 1.1180, which is the upper line of the Bollinger Bands on the daily chart. However, until buyers confirm their serious intentions by breaking the 1.1090 target, it makes sense to maintain a wait-and-see position on the instrument.