The GBP/USD currency pair quietly continued to rise on Thursday, although there was no significant event to explain it. However, a significant inflation report was released in Germany during the American trading session, which marked the start of a reasonably strong upward movement for the euro/dollar pair. The market kept buying euros despite the reality that inflation has significantly decreased. At the same time, there was the pound sterling, which had nothing to do with German inflation. The fourth quarter GDP report for the United States revealed an increase of 3.9%, which was entirely in line with expectations and therefore could not have an impact on the traders' mood. In general, we have been observing the pound's growth for the entire week and will continue to do so for the remainder of the week.

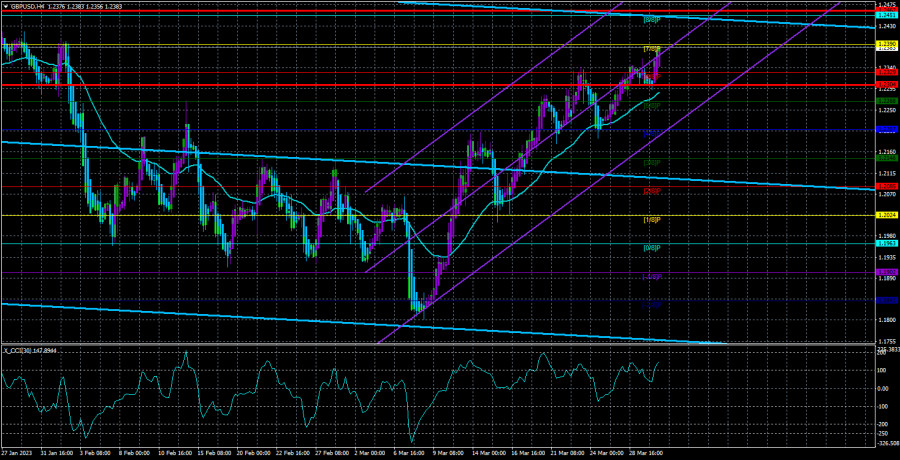

Of course, we can presume that the upward value of the euro and pound is a result of higher market expectations for ECB and BA rates. The Fed rate is likely to decline in 2023, which will likely lead to an increase in European currencies. It will be very difficult to predict when the majority of market participants will conclude that enough is enough, so you can plan for any upward movement along the length in this situation. Technically speaking, we are seeing exactly the movement that should be happening. First off, the pair has never been able to break below the moving average line on the 4-hour TF, despite making two attempts to do so. This has been the case since March 10. Second, after recovering from the bottom border of the side channel at the 24-hour TF (1.1840), the pair is still moving upward. The upper bound of 1.2440 serves as the target. As you can see, it is more confidently possible to describe the movement of the pound as rational.

The UK will eventually release the first report for the British pound on Friday. By the conclusion of the fourth quarter, the UK economy may grow by 0%, which is unlikely to support the pound sterling under normal circumstances. However, the outcome of this study is now irrelevant. Any valuation will result in further growth for the pound.

Hunt and Bailey make peculiar forecasts.

We only took notice of a few statements made by Great Britain's "top officials" in the interim because no significant information was shared during them. For instance, Finance Minister Jeremy Hunt stated that a chancellor who reduces taxes rather than raises them would be preferable to him. The Bank of England's interest rate, according to Mr. Bailey, will continue to increase but shouldn't reach the level of 2008. He also made several predictions that truly surprised people. The inflation prediction for 2023 is the one that resonates the most. The Bank of England anticipates that the consumer price index will decrease from its present level of 10.4% to 2.9% by the end of the year. Recall that while the United States also has no illusions about the rate of inflation slowing, inflation in the European Union is predicted to fall to 2.9% by the end of next year.

Jeremy Hunt added that, despite the possibility that the fourth quarter GDP report released today will show no increase, the British economy will not technically enter a recession this year. There is every reason to believe that the economy will continue to "cool down," given that the BA rate is rising (and he has no choice but to increase the rate further). Therefore, it is odd for us to see such predictions and odd to see the British pound's increase. We are aware of the market's higher projections for the BA rate, which is essentially the only growth driver, but it seems to us that this is insufficient to support growth above the crucial level of 1.2440. Additionally, if this level is not passed, a new fall to 1.1840 may start.

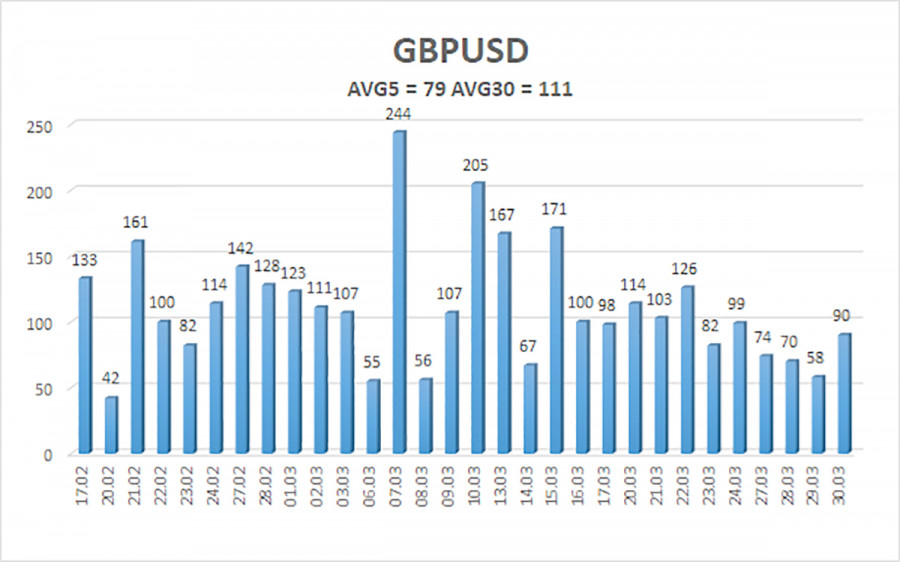

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 79 points. This value is "average" for the dollar/pound exchange rate. Thus, we anticipate movement inside the range on Friday, March 31, with the levels of 1.2304 and 1.2462 acting as resistance. A new phase of corrective action is indicated by the Heiken Ashi indicator turning downward.

Nearest levels of support

S1 – 1.2329

S2 – 1.2268

S3 – 1.2207

Nearest levels of resistance

R1 – 1.2390

R2 – 1.2451

R3 – 1.2512

Trading Suggestions:

In a 4-hour time frame, the GBP/USD pair is attempting to maintain the upward trend. Until the Heiken Ashi indicator goes down, you can continue holding long positions with targets of 1.2451 and 1.2462. If the price is set below the moving average with targets of 1.2207 and 1.2146, short positions may be taken into account.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.