The GBP/USD currency pair experienced low volatility on Friday, but last week's events can already be overlooked — Trump never sleeps. Traders barely had time to recover from last Thursday's events when Donald Trump introduced new tariffs. More precisely, he increased existing tariffs on steel and aluminum imports by 25%. Starting June 4, they will stand at 50%.

Was anyone expecting de-escalation in the Global Trade War? Was anyone hoping Trump would heed economists' advice and move toward reconciliation?

"We are going to raise tariffs on all imports of steel and aluminum to 50%," Trump announced during his speech in Pennsylvania. According to him, he initially intended to raise tariffs only to 40%, but "industry leaders said they need it at 50%." Frankly, there are huge doubts that the U.S. steel mills requested this hike. Even if true, the rest of American businesses will suffer, and inflation will rise even higher. It's evident that American steel and aluminum producers benefit from higher tariffs — there's always a side that gains from any decision. However, all companies that purchase steel and aluminum for production will pay more. Of course, it won't be the companies paying; higher costs will be passed down to American consumers via higher-end prices.

Thus, as we have said before, the American people will pay for America's supposed future greatness. Whether greatness will materialize is unknown, but Americans will foot the bill here and now. Trump also plans to lower certain types of taxes — but what's the point if prices across the board rise by 10-30-50% due to tariffs? Anyway, that's America's and Americans' problem since they re-elected Trump as president.

Trump also stated that a 25% tariff might be manageable for foreign suppliers, but no one can cope with a 50% barrier. "It's a great honor for me to raise steel and aluminum tariffs to 50%. Our steel and aluminum industries are being revived. This will be another Great step toward Making America Great Again," Trump declared.

There's little doubt that the dollar will again start sliding confidently downward on Monday. Most likely, the U.S. currency will plunge, especially against the British pound, which showed no signs of yielding to the dollar even when there were hopes for de-escalation and a hawkish Federal Reserve stance. Monetary policy hasn't interested traders much in recent months and is now relegated to a secondary or tertiary concern. Who cares about the Fed's key interest rate when events of this magnitude are unfolding?

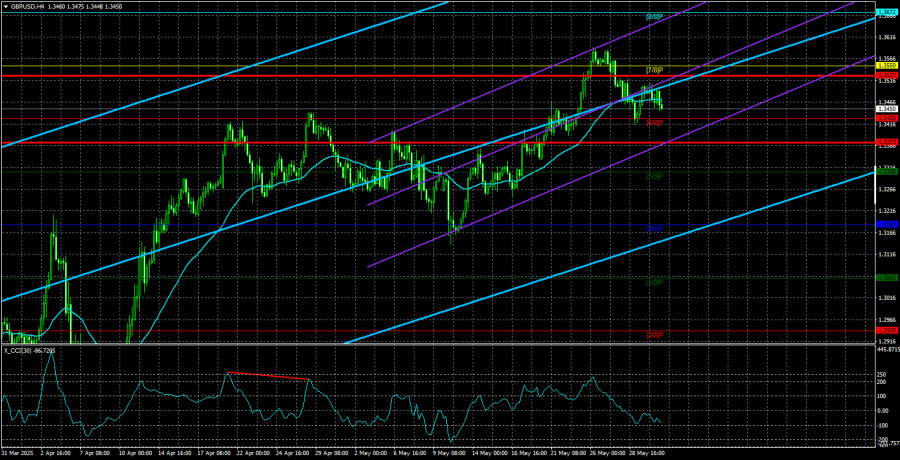

From a technical perspective, the GBP/USD pair closed below the moving average, but a sharp surge in quotes is expected on Monday.

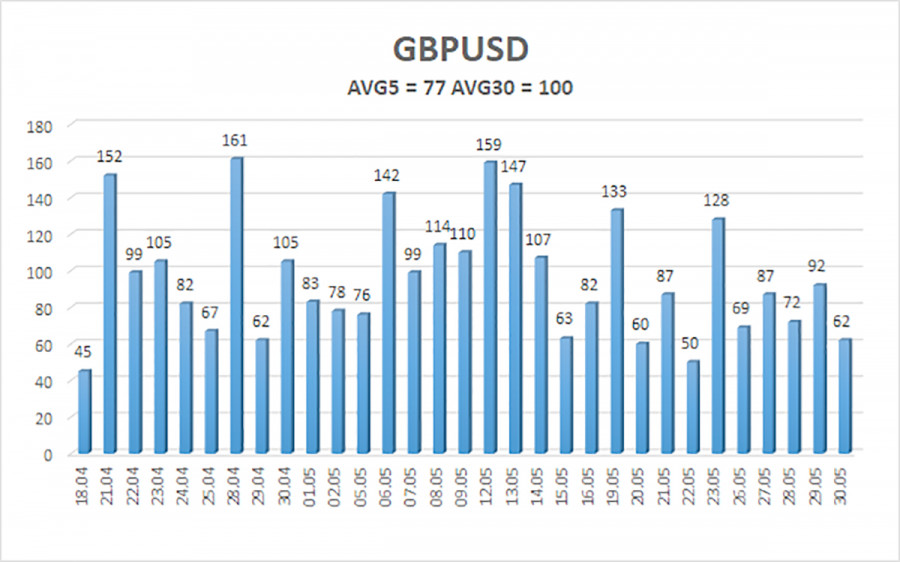

The GBP/USD pair's average volatility over the past five trading days is 77 pips, classified as "moderate." Thus, we expect the pair to move from 1.3373 to 1.3527 on Monday, June 2. The long-term regression channel is directed upward, indicating a clear uptrend. The CCI indicator has not entered extreme zones recently.

Nearest Support Levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest Resistance Levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading Recommendations:

The GBP/USD currency pair maintains its uptrend and continues to rise. There is no shortage of news supporting this movement. The de-escalation of the trade conflict both began and ended, but the market's aversion to the dollar remains. Every new decision by Trump or related to Trump is perceived negatively by the market. Thus, long positions remain valid with targets at 1.3550 and 1.3672 if the price stays above the moving average. Consolidation below the moving average would allow for short positions with targets at 1.3373 and 1.3306 — but who is expecting a strong dollar rally now? Occasionally, the U.S. currency may show minor corrections. Real signs of de-escalation in the Global Trade War are needed for a more substantial rise.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.