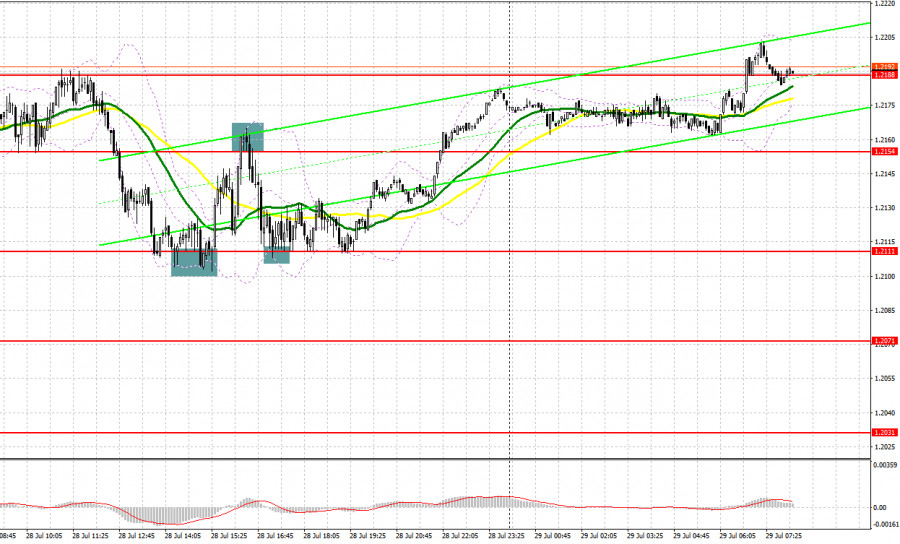

Several excellent market entry signals were formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 1.2143 level in my morning forecast and advised making decisions from it. I did not wait for a new wave of growth for the pound, and after an unsuccessful attempt to cling to monthly highs and a decline in the GBP/USD, I also did not see the bulls being active in the area of 1.2143. The second half of the day was much more interesting. Several false breakouts at the level of 1.2111 resulted in creating a signal to buy the pound, which was fully realized after the release of the US GDP report, which led to the pair's growth to the area of 1.2154, where I recommended taking profits. A false breakout at this level gave a sell signal, which quickly pushed the GBP/USD back to 1.2111, taking about 40 more points out of the market.

When to go long on GBP/USD:

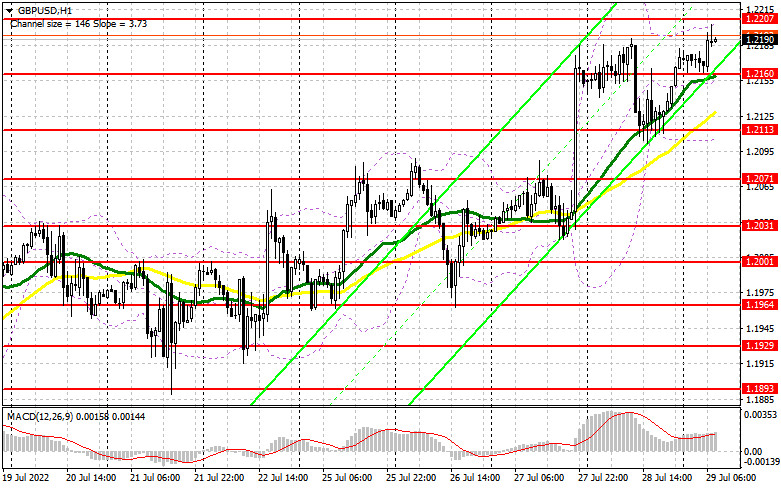

The weak report on the growth rate of the US economy in the 2nd quarter of this year greatly harmed the bears' plans to regain control over the market. Bulls managed to take advantage of this, having achieved an update of monthly highs at today's Asian session. Against this background, the whole technical picture has changed. Minor reports for the UK on the change in the volume of the aggregate M4 of the money supply and the volume of net loans to individuals in the UK will be released today, so they can be ignored. Therefore, I expect a further spurt of the pair and an update of monthly highs. Of course, the best scenario for buying the pound will be its decline and a false breakout in the area of the nearest support at 1.2160, where the moving averages play on the bulls' side. In this case, you can count on a new jerk of the pair up to 1.2207. A breakthrough of this level opens the way to a high like 1.2247, which will form a more powerful upward momentum and give a buy signal with the goal of a jump to 1.2285, where I recommend taking profits.

In case GBP/USD falls and bulls are not active at 1.2160, the pressure on the pound will increase, forcing the bulls to take profits later this month. If this happens, I recommend postponing long positions to 1.2113. I advise you to buy there only on a false breakout. You can open long positions on GBP/USD immediately for a rebound from 1.2071, or even lower - around 1.2031 with the goal of correcting 30-35 points within the day.

When to go short on GBP/USD:

Yesterday, bears did not expect such a development of the scenario, after a seemingly successful attempt to take control of the market in the first half of the day. Obviously, it will not be so easy for the bulls to break through the area above 1.2207 on the last trading day of July, although they have every chance for this. The optimal scenario for opening short positions will be a false breakout in the 1.2207 area after weak statistics on the UK, which will return pressure on the pound to move to the nearest support at 1.2160, formed on the basis of yesterday. A breakthrough and reverse test from the bottom up of this range will provide an entry point for selling with a fall to 1.2113, where I recommend partially taking profits. A more distant target will be the area of 1.2071. But even in this case, we can only talk about a significant correction of the pound to the area of the lower border of the new rising channel formed on July 14.

In case GBP/USD grows and the bears are not active at 1.2207 in the first half of the day, bulls will still be in control of the situation. In this case, I advise you not to rush into shorts. Only a false breakout around the new high at 1.2247 will give an entry point to short positions, counting on the pair's bounce to the downside. If traders are not active there, another upward spurt may occur. With this option, I advise you to postpone shorts to 1.2285, where you can sell GBP/USD immediately for a rebound, based on a rebound of the pair down by 30-35 points within the day.

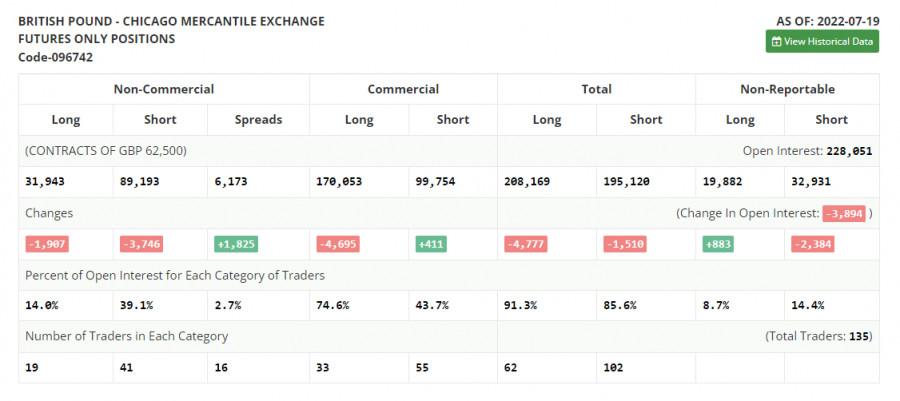

COT report:

The Commitment of Traders (COT) report for July 19 showed that both short and long positions decreased, but the former turned out to be slightly smaller, which led to a slight decrease in the negative value of the delta. It is clear that the bulls have bought back the yearly lows in the pound and are now trying in every possible way to show that the UK economy is not so bad and that the Bank of England's actions in relation to interest rates make sense. The pound's succeeding growth will depend on the Federal Reserve's decisions taken in the middle of this week. Obviously, the central bank will immediately raise interest rates by 0.75%, which may lead to the strengthening of the dollar, but on the condition that the central bank will continue to adhere to such an aggressive policy. If not, then the chance for the pound's succeeding growth will increase, as the BoE meeting will take place in August, at which interest rates may also be raised. However, it is not rational to expect that the pound bull market will last for a very long time, given the crisis in the cost of living in the UK and the economy gradually sliding into recession. The COT report indicated that long non-commercial positions decreased by 1,907 to 31,943, while short non-commercial positions decreased by 3,746 to 89,193, which led to a decrease in the negative value of the non-commercial net position to -57,250 from the level of -59,089. The weekly closing price increased and amounted to 1.2013 against 1.1915.

Indicator signals:

Moving averages

Trading is above the 30 and 50-day moving averages, which indicates the pound's succeeding growth.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the area of 1.2207 will act as resistance. In case the pair goes down, the lower border of the indicator around 1.2113 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.