On Tuesday, the EUR/USD currency pair maintained its upward trend. It's time to take a new look at both of these events after talking about the "swing" and the irrationality of the growth of the European currency for so long. From our perspective, the "swing" has not been postponed and is still in progress. The pair's recent substantial growth over the past two weeks does not rule out further significant growth in the pair's current direction. We are still unable to identify any compelling justifications for the significant growth of the euro. Recently, news about the Fed's cycle of tightening its monetary policy has started to surface, along with other unfavorable information from the Federal Reserve. This, of course, may place some pressure on the dollar. However, the strength of this news is insufficient to exert sustained pressure on the dollar. For instance, it was stated that the QT program may be terminated by the Fed. Given the circumstances, we think that it is virtually impossible to do so because doing so would be pointless. When this program is completed, the money supply in the United States will stop decreasing, and inflation may slow down. Additionally, it is now very common to believe that the Fed will either stop raising the key rate altogether or will only do so once more. Recall that the present decrease in inflation is only 3.1% and that another 4% must be added to reach the desired level. And let's be honest, the consumer price index has been under pressure recently as a result of many other factors as well as the Fed's rate increase.

The first factor is the decreased cost of electricity. Second, the QT program is the same. Third, the key rate has increased. That is, when all three of these variables were taken into account, there was a 3.1% decrease in inflation in the US. Now, if you can forget about tightening monetary policy, the QT program will end, and energy costs will no longer decline, which will cause inflation to travel further than the distance it has already covered in 8 months. Of course, the rate rise has a long-term effect on inflation, so based on prior increases, it might decline for a while. However, even in this scenario, we firmly doubt that without extra financial pressures, the consumer price index will be able to fall to 2% within a year.

The market has an excessively positive view of the euro.

Therefore, we believe all speculation and arguments that the ECB rate will rise above the Fed rate in 2023 to be somewhat unfounded. This may be the case, but how much higher will the ECB rate rise before the euro currency begins to grow over the long run, given that it has already increased by 1,500 points in just a few months against the dollar? After all, there was no discernible correction after this increase. It turns out that, against a fundamental backdrop that is challenging to describe as "strong," the euro currency is becoming almost recoilless. The European Union's growth rate will continue, according to Christine Lagarde, but the economy of the EU is already on the verge of collapse. If this continues, a decline will start.

Therefore, we believe that the European currency can continue to increase simply due to market expectations and the belief that the ECB's monetary policy will tighten more strongly than the Fed's policy. And technical indicators and instruments can be used to calculate this upward movement. The market will eventually understand, though, that the factors it depends on to make purchases aren't all that strong. The European currency must now continue to "swing" or adjust downward more forcefully, both of which are positive things. Additionally, we think that the euro's most recent round of development is excessively strong and out of the ordinary for the foreign exchange market. Usually, such rapid movements are followed by an equally swift and powerful correction. We, therefore, continue to anticipate the decline of the euro/dollar pair rather than its rise in the immediate future. However, until the moving average line is broken, it is not worthwhile to sell the pair for obvious reasons.

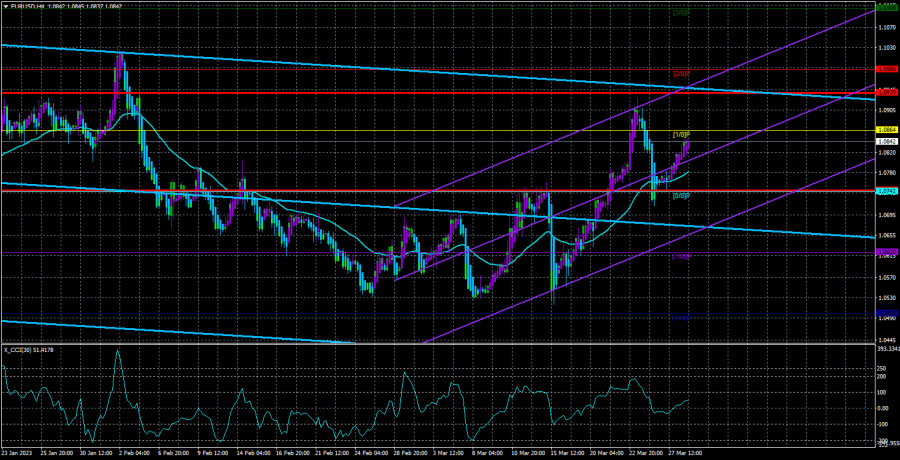

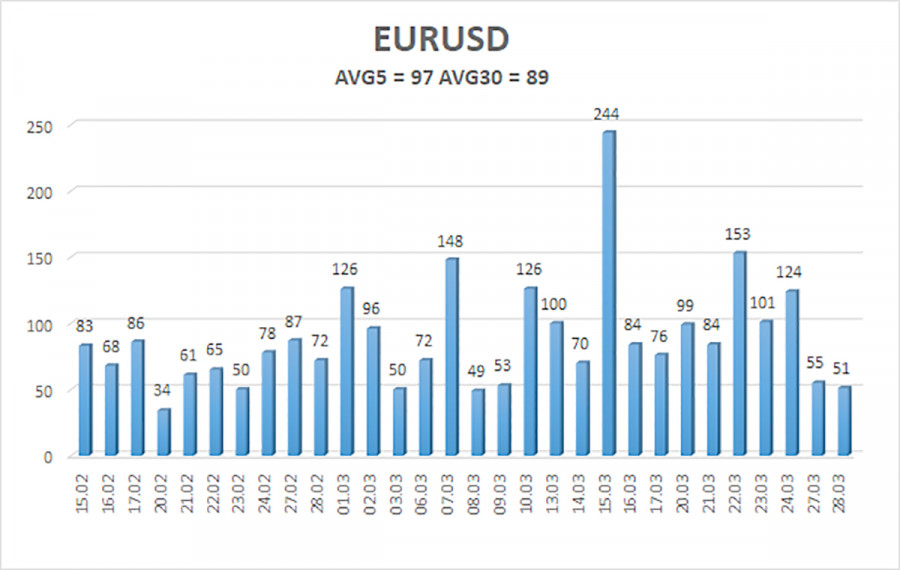

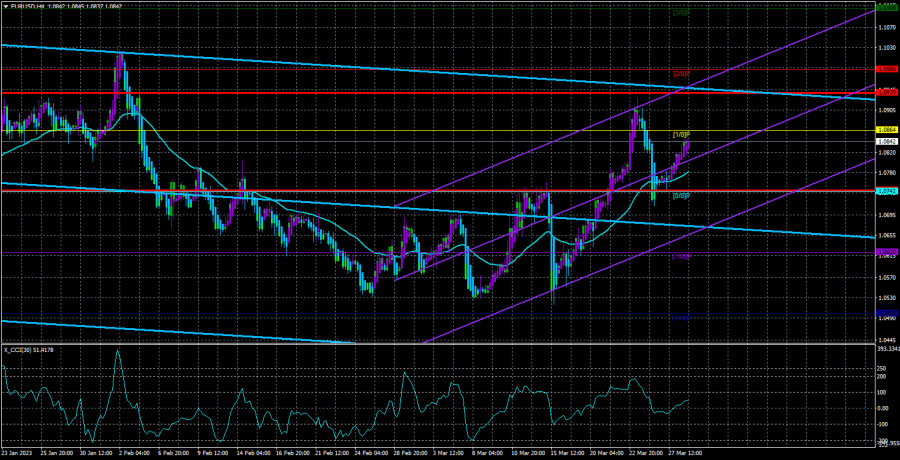

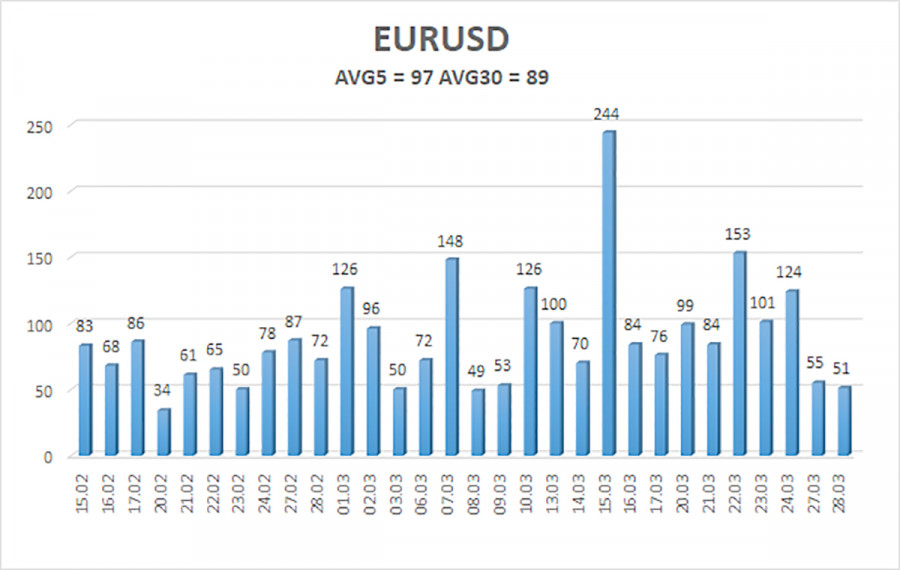

As of March 29, the euro/dollar currency pair's average movements over the previous five trading days was 97 points, which is considered to be "average." So, on Wednesday, we anticipate the pair to move between 1.0745 and 1.0939. A new round of downward movement will be signaled by the Heiken Ashi indicator turning back downward.

nearest levels of support

S1 – 1,0742

S2 – 1,0620

S3 – 1,0498

Nearest levels of resistance

R1 – 1,0864

R2 – 1,0986

R3 – 1,1108

Trading Suggestions:

The EUR/USD pair is trying to move higher once more. Until the Heiken Ashi indicator goes down, you can continue holding long positions with targets of 1.0864 and 1.0939. After the price is fixed below the moving average line, short positions can be opened with a target of 1.0620.

explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones..